World

Investors eye Indonesia for AI amid low energy costs, favourable policies

In addition to affordable energy, tech industry insiders have praised Indonesia’s “very welcoming stance” on foreign direct investment.

The Jakarta Post

Indonesia has emerged as a prime destination for artificial intelligence investment in Southeast Asia, driven by low electricity costs and supportive regulations, tech industry insiders say.

The country is seen to harbor potential for hosting data centers and fostering AI applications, even though foundational AI infrastructure is expected to remain concentrated in more established tech hubs such as the United States and China.

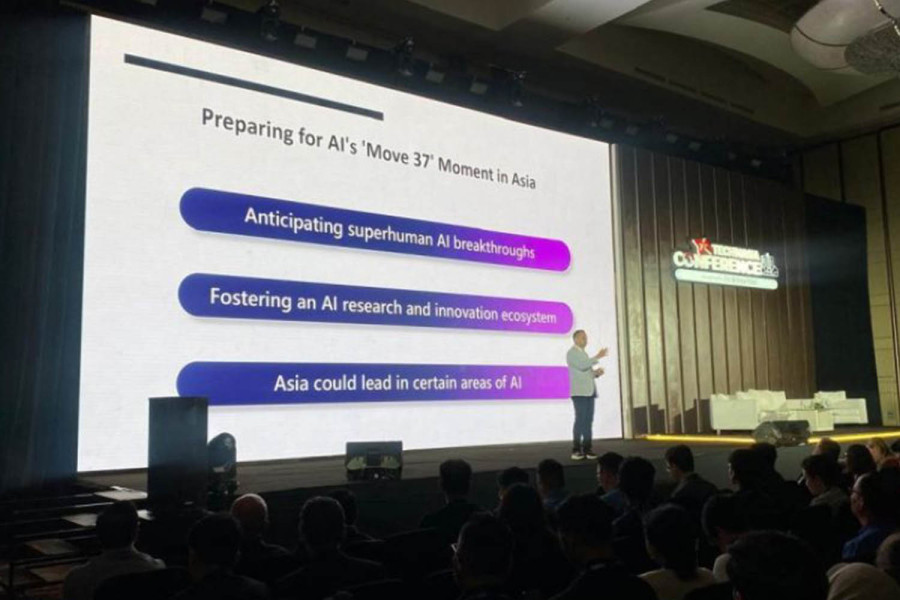

“I believe that, in terms of creating an infrastructure of AI, Southeast Asia is definitely not playing the game. The reason Malaysia and Indonesia are such hotspots for investment is because, among Asia, they have some of the lowest electricity costs,” said Esther Wong, founder and CEO of venture capital firm 3Cap, in a panel discussion at the Tech in Asia conference held in Jakarta on Wednesday.

In addition to affordable energy, Wong highlighted that Indonesia was also appealing for its “very welcoming stance” on foreign direct investment.

With its vast coastline, the country also had the ability to provide sustainable energy from sources such as tidal power, Wong pointed out, which could help reduce the energy burden of AI data centers.

Tech giants have committed more than US$55 billion in investments to the region since 2023, according to Tech in Asia data as of July plus a more recent investment by Oracle in Malaysia.

However, only $1.9 billion of that went to AI-related businesses in Indonesia, namely $1.7 billion from Microsoft and $200 million from Nvidia.

The ability to provide low-cost energy for IT infrastructure such as data centers is critical for the development of AI and for running AI-based applications.

Data centres consume significant amounts of energy for data processing and storage as well as for cooling systems, with AI applications being particularly demanding in terms of computing resources and therefore energy.

However, the data centre industry previously said Indonesia’s electricity prices, ranging from 11 to 12 cents per kilowatt-hour (kWh), were not competitive compared to Malaysia’s lower rate of 8 cents per kWh.

Despite the region’s potential to attract investment in AI infrastructure, experts believe Southeast Asia will likely focus on developing practical AI software solutions rather than foundational AI models like those built in the US and China.

Wesley Tay, principal at investment firm East Ventures, expressed confidence in the region’s ability to drive advancements in AI, particularly at the application level.

Start-ups in the region are increasingly adopting open-source models and large language models (LLMs) to build solutions tailored to local needs, particularly in the software-as-a-service (SaaS) sector.

“This application will then depend on the ability to gather the necessary data to train contextual data on top of open-source or closed-source models,” said Tay, underlining the role of data in differentiating AI solutions in Southeast Asia.

Zia Zaman, general manager at Microsoft Ventures, the tech giant’s venture capital arm, echoed this view, suggesting the region’s AI development was likely to be more pragmatic and focused on profitability rather than research.

He stressed the importance of looking beyond consumer-facing applications to how AI could empower businesses to operate more efficiently.

“It will be practical; it will rise to profitability quicker, and it will likely ease [business-to-business operations],” Zaman said. “Don’t just think [business-to-consumer], guys. There’s so much more value in thinking about that community at home.”

-In association with the Asia News Network

11.12°C Kathmandu

11.12°C Kathmandu